Tucson’s Housing Market in Focus: Navigating Rising Inventory and Affordability Challenges

The old saying, “The only constant in life is change” most definitely applies to real estate. Over the last 25 years I’ve navigated our nation’s housing market through many cycles of change. Today, a national paradox is once again reshaping our housing market landscape both here in Tucson and across the country: housing inventory is surging, yet sales are slowing. Here in Tucson, where historic adobe homes meet modern desert estates, this trend offers unique opportunities and challenges. I’d like to share with you what's driving this shift, how it impacts our vibrant city (and yours if you live elsewhere).

The National Context: A Surge in Inventory, A Pause in Sales

As I write this, the U.S. housing market is experiencing a notable imbalance: active listings have surged, but sales are slowing. According to Realtor.com’s April 2025 report, active listings climbed to 959,251, a 30.6% increase from April 2024. Yet, pending home sales fell by 3.2% year-over-year, reflecting buyer hesitation. The National Association of Realtors (NAR) reported a 5.9% drop in existing-home sales in March 2025, with the median* existing-home sales price rising 2.7% year-over-year to $403,700, marking the 21st consecutive month of price increases.

This trend traces back to the post-COVID housing boom (yes, Covid is still getting blamed for our current problems), when record-low interest rates and stifled buyer demand drove significant appreciation in home prices nationwide. As rates rose— currently averaging 6.85% for a 30-year fixed mortgage —my buyers face elevated sales prices and higher borrowing costs, dampening demand. The result is a market trending toward flush with homes but short on buyers, setting the stage for what makes Tucson’s housing dynamics unique.

While high prices and interest rates are primary factors in buyer hesitation, other concerns are also contributing: economic uncertainty, political and policy uncertainty, increased cost of home ownership, confusion about new rules in real estate, and more stringent lending practices.

But there’s light at the end of the tunnel!

Tucson’s Market: Stability Amid Rising Inventory

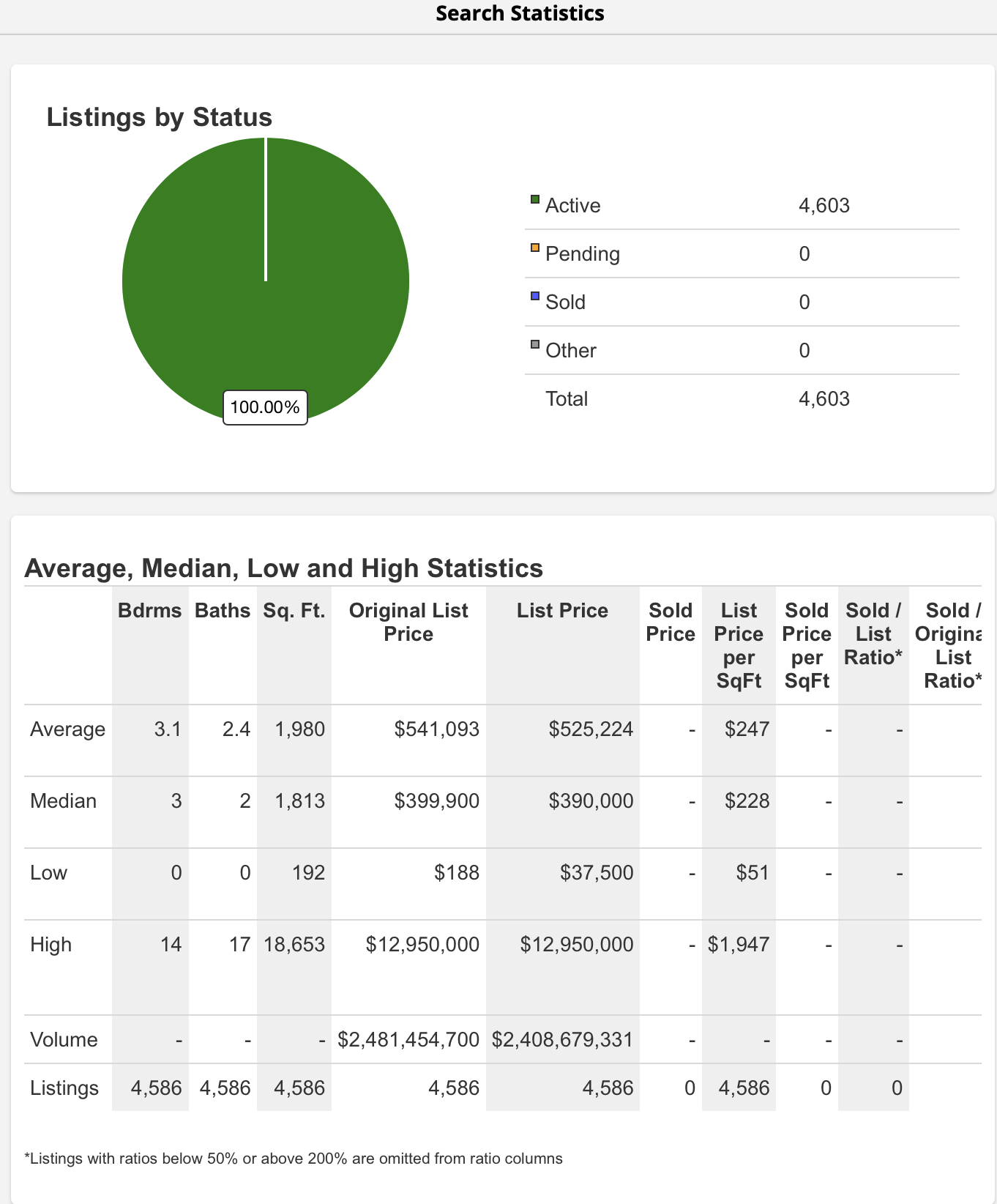

Our Tucson market mirrors the national inventory surge but stands apart with relative stability and a rosy 5-year forecast. As I write this article, the Tucson Association of Realtors shows 4,603 active home listings, a 54% increase from March 2025. The median list price was $399,900, with homes spending more days on the market before going under contract. Unlike the national 5.9% sales decline, Arizona’s year-over-year sales are stable to slightly higher, with Tucson buoyed by demand from active retirees in search of fun in the sun, second-home buyers, and professionals drawn to our industry and desert lifestyle.

Tucson’s rich heritage also enhances our local appeal. From Barrio Viejo’s Spanish Colonial adobes to the desert modern estates of the Catalina Foothills, our city weaves Native American, Mexican, and Spanish influences into a vibrant tapestry. Neighborhoods like Sam Hughes, where the median listing price is $597,500, offer historic charm, while Rita Ranch (median: $325,000) appeals to families seeking modern homes. Still, affordability remains a hurdle. Although Tucson’s median price of $399,000 is below the national average, with a median household income of $68,000 (2023), home ownership can strain many budgets.

Affordability: The Core of Tucson’s Challenge

“Affordability drives future appreciation,” as a colleague says, and Tucson’s post-COVID boom, fueled by low rates, saw home values rise significantly. This built equity for homeowners but now challenges my buyers, especially as rates have climbed. A $400,000 home at 6.85% now carries a monthly payment of about $2,650 (with 20% down), a substantial increase from three years ago.

My Collateral Analytics tool, exclusive to Russ Lyon Sotheby’s International Realty in Arizona, provides unparalleled insight. Used by Wall Street for mortgage-backed securities risk management, this bank-grade, 5-year forecast shows affordability constrains demand, even as inventory grows. In Tucson, three-bedroom homes saw a significant inventory spike in April 2025, with a notable percentage of homes selling below asking price, signaling a seller shift toward buyer-friendly conditions. For affluent clients eyeing luxury properties in areas like Dove Mountain or Oro Valley, this opens doors for negotiation.

Tucson’s Cultural Allure: A Market Beyond Numbers

Tucson’s housing market is as much about lifestyle as economics. Our heritage—from the Presidio San Agustín to the University of Arizona’s vibrant arts scene—draws buyers seeking a blend of history and modernity. Properties in Civano, with sustainable designs, or Flowing Wells, offering affordable starter homes, reflect Tucson’s diversity. As a stained glass artisan, I see parallels between crafting art and curating homes: both require an eye for what makes Tucson special. A ranch-style estate with Santa Catalina views or a restored Barrio Viejo adobe aren’t just homes; they are a unique piece of our vibrant story.

Looking Ahead: Tucson’s Path Forward

What lies ahead for Tucson’s market? As of this date, my Collateral Analytics forecast projects moderate appreciation through 2028, with annual price growth slowing to 2–4% as inventory outpaces demand. Nationally, NAR anticipates a sales boost as inventory improves, but affordability remains the key driver. Tucson’s stability, fueled by job growth in aerospace, biotech, and education, positions us well. The University of Arizona and employers like Raytheon Missiles & Defense continue to attract residents, tightening demand.

For affluent buyers, this is a strategic moment. Rising inventory offers choices, from historic gems in Sam Hughes to sprawling estates in the Catalina Foothills. My 25 years of boutique brokerage experience, paired with an artisan’s attention to detail, equips me to craft tailored strategies for my clients. As my colleague Mike Balzotti, “Mastery is the art of creating distinctions.” Whether buying, selling, or investing, I will help you seize Tucson’s home buying opportunities.

For Tucson home sellers, this means that, while rising inventory means more competition, Tucson’s enduring appeal and relatively stable prices give well-prepared sellers a strong position—especially those offering homes that are priced right, well-presented, and thoughtfully marketed. In today’s market, selling isn’t just about listing a property; it’s about telling its story in a way that resonates. With my deep knowledge of real estate sales, and my background in the arts, I help sellers highlight what makes their home unique—from architectural details to lifestyle potential. Strategic pricing, elevated presentation, and exposure through Sotheby’s global network ensure your property stands out, even in a shifting market.

Let’s Shape Your Tucson Story

While some home buyers may feel hesitant, Tucson’s housing market, like my stained glass, is an intricate mosaic of challenge and opportunity. Rising inventory and affordability hurdles demand expertise, but our city’s charm and stability offer a canvas for smart decisions. As your trusted broker with Russ Lyon Sotheby’s International Realty, I’m here with insights honed over decades of experience and exclusive tools like Collateral Analytics, all backed by Sotheby’s International Realty clout and marketing budget - quite frankly, a force to be reckoned with.

I’d love to connect. Let’s create something extraordinary for you in the heart of Tucson,

Warm regards,

Heather

Visit www.heather-neill.com to explore listings, dive into market trends, or contact me for personalized guidance.

*What's the difference between median and average?

- Average (also called the mean) is what you get when you add up all the numbers and then divide by how many numbers there are.

Example: If five homes sold for $100K, $200K, $300K, $400K, and $1 million, the average price is skewed by that $1 million home — it ends up being $400K, even though most homes sold for much less. - Median is the middle number when all the prices are lined up from lowest to highest.

In that same example, the median is $300K — right in the middle — and gives a better sense of what's typical in the market.

Why it matters:

In real estate, median is usually more accurate for understanding what most buyers and sellers are dealing with — because it’s not thrown off by a few extremely high or low prices.